The latest grim trends … and the “best single article I’ve read on the current phase of the economic crisis”

Sep 16th, 2011 | By L. Frank Bunting | Category: Key Current Issues A little too unhappily, this week began with reports from our Canadian banks on slower growth prospects for the domestic economy. See, eg, on Monday, September 12: “Canada’s growth to slow, RBC says” ; and then, just one day later: “Canada could be 1st into recession, bank warns.”

A little too unhappily, this week began with reports from our Canadian banks on slower growth prospects for the domestic economy. See, eg, on Monday, September 12: “Canada’s growth to slow, RBC says” ; and then, just one day later: “Canada could be 1st into recession, bank warns.”

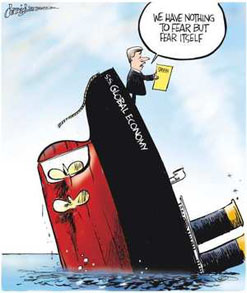

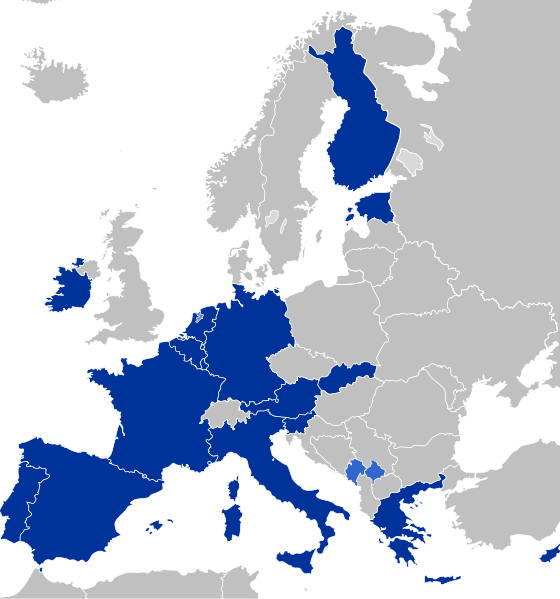

At the bottom of these prognostications were “a ‘mild contraction’ in Canada in the second quarter and slower growth in the US and the economies that form the eurozone.” And while “the risks to global recovery have intensified as both the US and European economies show signs of slowing,” there was also some agreement “that Europe has increasingly become a worry … There’s been growing speculation that Greece will default on its debt, something that threatens to create a European banking crisis … ‘We’ve seen a very slow-moving train wreck in Europe.’”

As the week wore on, the Globe and Mail in particular offered assorted further news and reflections on the increasing worries about Europe. Early Wednesday evening the estimable Eric Reguly in Rome posted a provocative piece: “Euro zone crisis? It’s more like Armageddon … The euro zone is not in crisis. It is far worse than that … This is a slow-motion suicide made gorier by feckless political leadership. It is now morphing into a banking crisis, one with the potential to plunge the European and global economies into a full-blown recession or worse.”

The next day there were two more reports. To start with we heard that “Euro zone economy will grind to halt by year-end, EU warns … The EU Commission warned Thursday that economic growth in the euro zone will come to a near standstill by the end of the year due to the European debt crisis and the turmoil in financial markets.” Then early Thursday afternoon there was a piece that started out well enough, but ended on another sobering note: “Major central banks come to Europe’s aid … The European Central Bank and a posse of other big official lenders are attempting to chase fear out of global financial markets, pledging to ensure Europe’s stressed banks have access to dollars.” In the end, however, this “‘latest dollar funding scheme addresses the symptoms, not the illness,’ Win Thin, an economist at New York-based Brown Brothers Harriman told clients in a note. ‘The illness is that Greece is insolvent, and one of the symptoms is that banks are afraid to lend to each other and are instead hoarding cash.’”

All this finally took me back to what had seemed an especially enlightening article in the September 8 issue of the London Review of Books, by an eminently readable UK journalist (and sometime novelist and food critic), entitled “The Non-Scenic Route to the Place We’re Going Anyway … John Lanchester on the global economy.”

All this finally took me back to what had seemed an especially enlightening article in the September 8 issue of the London Review of Books, by an eminently readable UK journalist (and sometime novelist and food critic), entitled “The Non-Scenic Route to the Place We’re Going Anyway … John Lanchester on the global economy.”

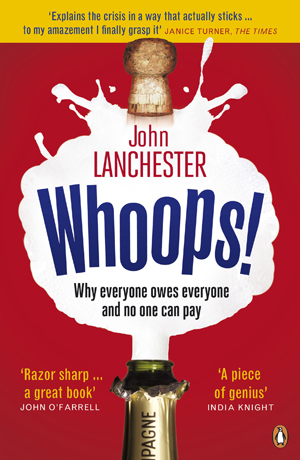

Of course, you might say, who is John Lanchester, and why should any one pay any attention to him? If you have 25 minutes to spare, you can see him on You Tube, explaining his entertaining short book of 2010: Whoops! Why Everyone Owes Everyone and No One Can Pay (aka I.O.U.: Why Everyone Owes Everyone and No One Can Pay in North America). It is also worth noting that while Lanchester himself is something of a literary bohemian, “his father was an old-fashioned banker for the Hong Kong and Shanghai Bank, a conservative institution flecked with the legacy of empire, but which these days – like the rest of finance –Â has been taken over by the maths geniuses.” And “The Non-Scenic Route to the Place We’re Going Anyway … John Lanchester on the global economy,” in the September 8, 2011 issue of the London Review of Books, has been described by assorted eminent bloggers on this side of the pond as “Europe-focused, but …Â the best single article I’ve read on the current phase of the economic crisis.”

* * * *

John Lanchester as a very young man, with his mother Julie. He was born in 1962 in Hamburg, Germany, brought up in Hong Kong where his father worked in a bank, and educated in England, at Gresham's School, Holt and St John's College, Oxford.

The best advice I can offer about John Lanchester’s “The Non-Scenic Route to the Place We’re Going Anyway” is just read it for yourself. But it does weigh in at over 3,000 words. And if that seems like absolutely too much space-time for you right now, here are a few of what strike me as the most striking passages:

* “The [US] dollar is the de facto global ‘reserve currency’ … The fact that the US can print as much of this global reserve currency as it likes … gives it more or less unlimited power to borrow money in times of trouble … This is …Â a very easy …Â power to abuse by accumulating huge debts, but what caused the [recent] downgrade [in the US credit rating, by Standard and Poor] … was the Congressional Republicans’ brinkmanship over what should have been the routine raising of the ceiling on the total amount of US debt …Â The disturbing thing about the whole process [was] … that the Tea Partiers were … consciously pursuing a course of action which made no economic sense, as part of a worldview which is essentially theological … ‘Sane Republican’ is not an oxymoron, not yet –Â but we’re heading that way.”

John Lanchester is also apparently a cook of some accomplishment, and sometimes writes about food as well as the current global economic crisis.

* “If economies aren’t growing, they’re going to have trouble repaying their debts – debts which, to a large extent, they took over from the global banking system, to keep it solvent … this is a huge problem for the eurozone in particular … The European Central Bank figures tell the story: in a single week, they provided €22 billion in emergency funding … ECB lending on that scale can’t be kept up, but numbers that big are necessary because other banks had stopped lending to the endangered banks … Everybody and his cat knows that the eurobond is the only way out of the crisis for the eurozone in the medium term; as for the necessary size of the short-term bailout facility, Gordon Brown’s guesstimate was €2 trillion. That ‘could have convinced the markets that Europe meant business’. Huge, sustained … government intervention on that scale is the only thing which will cause the speculators and hedge-funders and ‘hot money’ types to back off. Instead, nothing. The markets expressed their opinion the only way they know, and on 17 August, the ECB had to lend another €9-10 billion to the endangered banks.” [And this process has carried on into September, as above in “Major central banks come to Europe’s aid … pledging to ensure Europe’s stressed banks have access to dollars.”]

* “It is this failure of political will both in the EU and US which is starting to make the contemporary economic scene resemble that of the 1930s. The discipline of macro-economics was born out of the study of the Great Depression, in an attempt to … avoid a repetition. That’s why it’s so depressing to see the developed world not just sleepwalking towards another recession, but actively embracing policies which make it more likely. Governments can’t all simultaneously cut spending while also continuing to grow their economies …The problem is in large part to do with the application of an incorrect metaphor, the easy-to-understand idea that a household has to live within its income. But governments are not households, and the idea of cutting your way to prosperity … and the refusal to embrace stimulus spending, are causing economic slowdowns all over the world that are triggering the current anxiety in the markets, which is in turn causing the predicament of governments to intensify, as confidence sinks and the self-fulfilling expectations of a second downturn take hold.”

* “It’s starting to look as if the best-case scenario for the aftermath of the [2008] crash is already dead. In that version, governments muddled through to economic growth, cutting public spending in the process, enjoying the … rebound which tends to follow recessions … This prospective version of events had a big hole at the centre, about the way the financial sector should be reformed … The next scenario – the one we are on course for at the moment – is not so much the next-best as the next-least-worst. It is modelled on what happened to other parts of the world over recent decades, from Latin America to Russia to South-East Asia, as they underwent debt crises and consequent economic collapse. In all cases, the relevant economies recovered, after about a decade of hard times and widely shared economic pain. In this model, the debts are gradually paid down, the economy is slowly and miserably rebalanced, and eventually things grow back to where they were when the bubble burst.”

* “There is a general sense of baffled incomprehension in the West at the idea that this should be happening to Us, instead of to Them … But that is what we look to be on course for at the moment … Would that matter? It would be a fairly important chapter in the Decline of the West, to be sure … but in the very broadest economic and historical perspective, it might only be an acceleration of trends which are already in place. We are on course for relative decline, compared to China and India and the developing world; indeed, we are already living through it … A decade-long slowdown would accelerate this shift in global wealth and power and would be a grim thing to live through, but from a world-historical perspective it might not be a game-changer: it might just be the non-scenic route to the place we’re going anyway.”

The Gilbert Scott restaurant in London – a place John Lanchester especially likes, and a refuge for at least some perhaps during the “ten-year slog” that he suspects probably lies ahead of all the old “developed” economies, in Europe, North America, and Japan?

* “What makes the process so frustrating is that the measures which might be taken to avoid the years of stagnation seem fairly obvious. The first of them is to embark on a medium-term plan of stimulus and spending to help growth; to postpone the cuts and austerity and rebalancing of spending until that growth is established; and to embark on a global plan to reform the financial system. This plan would have to be co-ordinated and international, and it might well involve a shift towards what is being called the ‘utility model’ of banking … Many of the casino-like activities in which banks currently engage … will be banned … There is, just, time for this change of course to happen, before it’s all too late. But I fear that the grip of anti-spending ideology is so strong throughout the West, and the politicians’ fear of the banks is so entrenched, that the ten-year slog looks more likely …”

Here in North America, no doubt, the prospect of Lanchester’s “global plan to reform the financial system … co-ordinated and international,” and involving “a shift towards what is being called the ‘utility model’ of banking,” in which many “of the casino-like activities in which banks currently engage … will be banned,” seems even more unlikely than it does in what some Canadians apparently still regard as the old imperial metropolis of London, England. And until further developments credibly suggest something different, I’m doing everything I can to prepare myself and what modest resources I can muster for “the ten-year slog.”

[…] original post here: The latest grim trends … and the “best single article I’ve read on the current phase of the ec… Posts Related to The latest grim trends … and the “best single article I’ve read on the […]

http://onlinebanking.businesskaki.com/the-latest-grim-trends-%E2%80%A6-and-the-%E2%80%9Cbest-single-article-i%E2%80%99ve-read-on-the-current-phase-of-the-economic-crisis%E2%80%9D/