LSE-TMX merger/takeover .. how many debates about the economics of the Canadian future can we have in 2011?

Feb 10th, 2011 | By Citizen X | Category: Key Current Issues

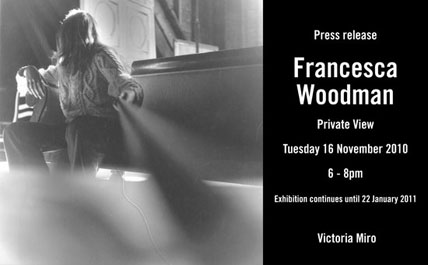

Press release poster for Francesca Woodman exhibition at the Victoria Miro Gallery in the Islington neighbourhood of London, 16 November 2010 – 22 January 2011. Ms. Woodman was born in Denver, Colorado in 1958 to artistic parents. She spent parts of her childhood in Florence, Italy, and her late teens in Rome. She began taking her remarkable photographs when she was 13. She committed suicide in New York in 1981 – the Sylvia Plath of photography.

In 1933 the incomparable Percy Robinson published his still too-neglected minor classic, Toronto during the French Regime, 1615—1793. In the book’s last chapter he noted how, in the 1930s, the capital city of Ontario (then still only the second-largest city in Canada, behind Montreal) was “the citadel of British sentiment in America.”

Over the subsequent three-quarters of a century things have changed – and not just because wave after wave of global migrants from an increasingly vast diversity of non-British origins have moved to the Toronto region. Many long-established residents whose parents and grandparents and great grandparents were of British and other origins have come to think of themselves as Canadians, first, second, and last.

“Last week I went to an exhibition of photographs by Francesca Woodman ... I'm really glad I did because the work is wonderful.”

In the early 21st century city region the proposal for a London Stock Exchange merger with (or some would stress, takeover of) the Toronto Stock Exchange, suddenly made public in the wake of last Friday’s Canada-US “Beyond the Border Working Group” announcement in Washington, is bound to have a kind of old neo-colonial ring in many local and even regional ears.

So “Ontario Finance Minister Dwight Duncan [from faraway Windsor, just across the river from the old French Canadian fort at Detroit] expressed major concerns about the transaction, saying London would end up controlling the merged entity and that the deal raises many unanswered questions … ‘This is a significant development that affects our capital markets, that affects our country, that affects our place in the world.’”

* * * *

Many other things in the global village have also changed over the past three-quarters of a century of course. In fact the merger/takeover proposal involves the London Stock Exchange (LSE) and something known as TMX Group, which “owns and operates … the Toronto Stock Exchange, and the TSX Venture Exchange … the Montreal Exchange, the Natural Gas Exchange and the Boston Options Exchange.” And the TSX Venture Exchange alluded to here “is headquartered in Calgary … and has offices in Toronto, Vancouver, and Montreal. It was previously known as the Canadian Venture Exchange … created by the merger of the Vancouver Stock Exchange … and the Alberta Stock Exchange.”

The current CEO of TMX Group, Thomas A. Kloet, is an American, who “graduated … from the University of Iowa in 1980,” and among many other things was previously CEO of “Singapore Exchange Ltd.” (which has more recently merged with the Australian stock exchange). The current CEO of the London Stock Exchange (LSE – also short for London School of Economics, but forget about that) is Xavier Rolet, a native of Aix-les-Bains, France, and graduate of Columbia Business School in New York, whose previous employers include Goldman Sachs, Credit Suisse First Boston, Dresden Kleinwort Benson, and Lehman Brothers in France. And for added international glitter here, the Borsa Italiana, based in Milan and “Italy’s main stock exchange … was acquired by the London Stock Exchange in 2007.”

In Canada alone the proposed LSE-TMX deal must be approved (it already seems clear enough) by “regulatory gnomes in Toronto, Montreal and Ottawa.” And: “While LSE and TMX executives stressed repeatedly that the union was a ‘true merger of equals,’ it is clear that the LSE will have the upper hand … In addition to taking the CEO’s seat, LSE shareholders will own 55 per cent of the new group, with TMX shareholders owning the rest. The new company will have 15 directors, eight from the LSE and seven from the TMX, meaning LSE appointees will have control of the boardroom.”

Will that finally be good for Canada? As in the case of the new Canada-US Beyond the Border Working Group, 2011 is shaping up as a year of profound naval gazing about the Canadian future – which maybe even ought to take place in the context of yet another federal election campaign?

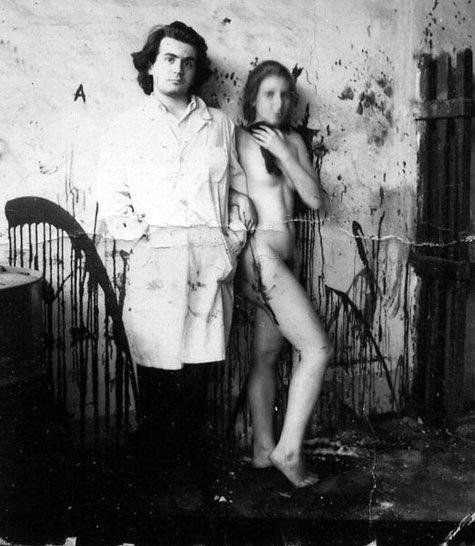

Frances and friend. Hardly pornography, but ... what? Angelic, some suggest? Powerful darkness others say?

Some immediate reaction from across the pond also suggests that certain questions are already being raised in the old imperial metropolis too. Nils Pratley at guardian.co.uk, has just written: “On Wednesday morning the London Stock Exchange thought it had secured a deal to join the top division of global exchanges: a ‘merger of equals’ with TMX of Canada to create a combo ranked fourth by revenues. At teatime came news that Deutsche Börse and NYSE Euronext, numbers two and three by size, are in merger talks … their move has thrown a large spanner in the works for the LSE and TMX. Shareholders in both companies will rethink. Rather than merging, would it be better to wait until the tide of consolidation produces a takeover bid at a (hopefully) fat premium? … For now, Xavier Rolet, chief executive of the LSE, probably has to plough on with the merger talks with TMX. Completion is not due until October, which leaves time to explore alternatives. Rolet clearly has to find a deal of some sort – but it’s not obvious that Canada is still the best place to look.”

Mmmm … stay tuned of course. It seems likely enough that there will be more than a few further cases of “the plot thickens” on this file.

There is a discussion of the Victoria Miro Francesca Woodman photographs that accompany this article, by Brian Dillon, in the 20 January 2011 issue of the London Review of Books.

[…] This post was mentioned on Twitter by Democracy Reform. Democracy Reform said: LSE-TMX merger/takeover .. how many debates about the economics of the Canadian future can we have in… http://bit.ly/hkXEvO #demreform […]

http://topsy.com/www.counterweights.ca/2011/02/lse-tmx-mergertakeover-how-many-great-debates-about-the-economic-base-of-the-canadian-future-can-we-have-in-2011/?utm_source=pingback&utm_campaign=L2