What’s happening to the Canadian economy .. does it point to US $ crisis ahead?

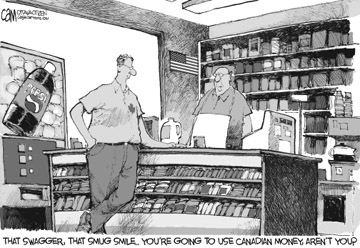

Nov 3rd, 2007 | By Counterweights Editors | Category: Key Current Issues SATURDAY, NOVEMBER 3, 2007 [UPDATED NOVEMBER 8]. The Canadian dollar touched somewhat more than $1.07 US in international money market trading yesterday – said to be its highest value since the late 19th century. (It has since gone as high as $1.10, and then back to the $1.07 range.) But that’s just the half of it. Part of the alleged driving force is a “much stronger-than-expected jobs report” from Statistics Canada. And if you compare this with a parallel “robust” report from the US Labor Department, you can see just how crazy the true north strong and free has apparently started to become. As the New York Times has explained, the US “economy added 166,000 jobs in October, the fastest pace in five months.” On the usual calculations, based on relative US-Canadian population sizes, Canada would have done well if it had added about 18,000 jobs over the same period. But how many did it add in fact? Would you believe 63,000? You might as well. Because, according to Statistics Canada, that is more or less the truth. Which finally must lead any sensible person to ask just what is going on?

SATURDAY, NOVEMBER 3, 2007 [UPDATED NOVEMBER 8]. The Canadian dollar touched somewhat more than $1.07 US in international money market trading yesterday – said to be its highest value since the late 19th century. (It has since gone as high as $1.10, and then back to the $1.07 range.) But that’s just the half of it. Part of the alleged driving force is a “much stronger-than-expected jobs report” from Statistics Canada. And if you compare this with a parallel “robust” report from the US Labor Department, you can see just how crazy the true north strong and free has apparently started to become. As the New York Times has explained, the US “economy added 166,000 jobs in October, the fastest pace in five months.” On the usual calculations, based on relative US-Canadian population sizes, Canada would have done well if it had added about 18,000 jobs over the same period. But how many did it add in fact? Would you believe 63,000? You might as well. Because, according to Statistics Canada, that is more or less the truth. Which finally must lead any sensible person to ask just what is going on?

1. Comparability of US and Canadian labour force statistics …

One technical point that some might want to raise about comparisons between US and Canadian job-creation statistics is that they are not comparing exactly the same things, in the absolute strictest sense of various technical definitions and concepts.

One technical point that some might want to raise about comparisons between US and Canadian job-creation statistics is that they are not comparing exactly the same things, in the absolute strictest sense of various technical definitions and concepts.

If you really want to go into the exasperating details of all this (Canada says “working age” means 15 and over, the US 16 and over, etc, etc), you can consult such documents as: “Comparative Civilian Labor Force Statistics, 10 Countries, 19602004” ; “Comparative Economic Statistics: Unemployment and Inflation” ; W. Craig Riddell, “Why Is Canada’s Unemployment Rate Persistently Higher than that in the US?” ; and Stephen R.G., Jones and W. Craig Riddell, “The Dynamics of Labor Force Attachment in the US Labor Market“.

Some difficulties in such comparisons are reflected in the conclusion to the third of these studies: “we do not yet have a definitive explanation for the change in the labour force attachment of non-employed Canadians relative to Americans. As a consequence we cannot confidently assess the significance of the structural unemployment gap. One view is that Canada’s higher unemployment reflects greater unutilized labour supply, and a serious waste of human potential. At the other extreme, an alternative view is that the division between unemployment and non-participation is murky, and America’s lower measured unemployment may largely reflect different labeling’ of otherwise similar behaviour. Either position can be defended.”

Some difficulties in such comparisons are reflected in the conclusion to the third of these studies: “we do not yet have a definitive explanation for the change in the labour force attachment of non-employed Canadians relative to Americans. As a consequence we cannot confidently assess the significance of the structural unemployment gap. One view is that Canada’s higher unemployment reflects greater unutilized labour supply, and a serious waste of human potential. At the other extreme, an alternative view is that the division between unemployment and non-participation is murky, and America’s lower measured unemployment may largely reflect different labeling’ of otherwise similar behaviour. Either position can be defended.”

The practical point for our own case here is that even all the various technical anomalies of this sort taken together could not finally explain away all of the difference in the October 2007 labour force surveys. Without inquiring into such nuances, e.g., in October 2007 the Canadian economy (whatever that itself may exactly mean) created 63,000 / 18,000 or some 3.5 times more jobs than the US economy, based on what you might expect from comparative population statistics. (I.e. current Can pop = 32,976,026 ; current US pop = 303,275,113 ; 32,976,026 / 303,275,113 = 0.10873 ; 166,000 US jobs x 0.10873 = 18,049.) Once you allow for all the conceivable technical measurement differences and so forth, it may be that the Canadian economy created only 3 times as many jobs, relative to population size, as the US economy – or even only 2.5 times as many, or say just 2 times as many, and so forth. But that is still quite a large difference.

2. Looking at the October 2007 Labour Force Survey in Canada a little more closely …

If all such technical anomalies still leave considerable room for marveling at Canada-US differences in the October 2007 job-creation statistics, just a somewhat closer look at the Labour Force survey in Canada does suggest clearly enough that the numbers don’t exactly point to any striking differences in the real strength of the Canadian and US economies – or any altogether unusually benign and encouraging strictly economic trends in Canada.

If all such technical anomalies still leave considerable room for marveling at Canada-US differences in the October 2007 job-creation statistics, just a somewhat closer look at the Labour Force survey in Canada does suggest clearly enough that the numbers don’t exactly point to any striking differences in the real strength of the Canadian and US economies – or any altogether unusually benign and encouraging strictly economic trends in Canada.

Consider, e.g., this Statistics Canada reportage: “Employment continued to rise in October, jumping an estimated 63,000, split between full and part time …

“Workers aged 55 and over accounted for the majority of the employment gain in October. With these gains, the proportion of persons aged 55 and over who were employed reached its highest level, at 32.2%. Employment for older workers has risen 6.9% since the start of 2007, in contrast to 1.2% for those aged 25 to 54.

“For the second consecutive month, more than half the increase in employment occurred in Ontario. In October, employment increased 32,000 in this province …

“For the second consecutive month, more than half the increase in employment occurred in Ontario. In October, employment increased 32,000 in this province …

“After slow growth throughout most of 2007, employment grew strongly in Ontario for the second consecutive month … mainly in part time. So far in 2007, employment in Ontario has risen an estimated 1.7%, still below the national average of 2.1%.

October’s employment growth in Ontario was mainly in public administration and other services’. The growth in public administration was due, in part, to the provincial election, which coincided with the Labour Force Survey reference week.

“At the national level, October’s employment increase was in the service sector, most notably in health care and social assistance, other services’, and public administration. However, this strength was tempered by losses in business, building and other support services, as well as accommodation and food services.

“At the national level, October’s employment increase was in the service sector, most notably in health care and social assistance, other services’, and public administration. However, this strength was tempered by losses in business, building and other support services, as well as accommodation and food services.

“Spurred on by the gains in health care and public administration, employment growth in October was concentrated among public sector employees. With stronger growth in recent months, employment in the public sector has increased 5.6% so far in 2007 …

“Of all industries, health care and social assistance posted the strongest estimated employment growth in October (+29,000). There was also an increase in other services’ (+24,000), an industry that covers a variety of activities, such as dry cleaning and laundry services, electronic and precision equipment repair and maintenance, as well as grant-making and giving services. As well, public administration added an estimated 20,000 workers in October, all in Ontario.

“Of all industries, health care and social assistance posted the strongest estimated employment growth in October (+29,000). There was also an increase in other services’ (+24,000), an industry that covers a variety of activities, such as dry cleaning and laundry services, electronic and precision equipment repair and maintenance, as well as grant-making and giving services. As well, public administration added an estimated 20,000 workers in October, all in Ontario.

“In contrast to the growth in the service sector, there has been overall weakness in the goods-producing industries, where employment has edged down 0.5% since the start of the year. So far in 2007, significant losses in manufacturing have been almost completely offset by robust gains in construction and utilities. In October, utilities was the only industry in the goods-producing sector to show signs of strength. Utilities include electric power generation, transmission and distribution, natural gas distribution, and water supply and sewage systems.”

3. Oil in Alberta and the Canadian $ …

As the Vancouver Sun has explained: “Along with the impressive employment numbers, the loonie got an extra boost … from a rebound in world prices for oil, which jumped to almost $95 US a barrel.” There can be little doubt that much of the great recent strength in the Canadian dollar has been driven by the petro legacies of dead dinosaurs, mostly in Alberta. And this raises the talk that started a while back now, about how the Canadian dollar has lately become an essentially petro currency.

As the Vancouver Sun has explained: “Along with the impressive employment numbers, the loonie got an extra boost … from a rebound in world prices for oil, which jumped to almost $95 US a barrel.” There can be little doubt that much of the great recent strength in the Canadian dollar has been driven by the petro legacies of dead dinosaurs, mostly in Alberta. And this raises the talk that started a while back now, about how the Canadian dollar has lately become an essentially petro currency.

A somewhat more sophisticated view is that oil (and oil sands) in Alberta has only led an early 21st century revival of the traditional Canadian resource economy – that goes back to the growth of the transcontinental (and “Indian-European” multicultural) fur trade of Canada, in the 17th, 18th, and early 19th centuries. And resource economies are notoriously “cyclical.” Sometimes the cycles – and resource product prices – are good, and sometimes not. For various reasons (including dynamic new growth in China and India) right now they are good!

In particular, as the Vancouver Sun has also explained, the loonie lately has also received an extra boost from “a healthy rise in [the price of] gold, which was up to more than $800 US an ounce.” More generally, as a website devoted to today’s international mining industry explains: “Canada is the world’s largest exporter of minerals and metals.”

In particular, as the Vancouver Sun has also explained, the loonie lately has also received an extra boost from “a healthy rise in [the price of] gold, which was up to more than $800 US an ounce.” More generally, as a website devoted to today’s international mining industry explains: “Canada is the world’s largest exporter of minerals and metals.”

Thus, e.g., it is often and rightly enough said that the dramatic recent rise in the Canadian dollar – which owes as much as it clearly does to the current Western (and Eastern) Canadian oil industry bonanza, especially concentrated in Alberta – has actually been quite harmful to the interests of Central Canadian manufacturers (and especially automobile manufacturers in Ontario, next door to the old US auto manufacturing heartland in Michigan). But:

* “British Columbia, Ontario, Quebec and Manitoba account for most copper production in Canada, with British Columbia being the largest” and “Ontario, the second largest …”

* “British Columbia, Ontario, Quebec and Manitoba account for most copper production in Canada, with British Columbia being the largest” and “Ontario, the second largest …”

* “Diamond exploration is currently taking place in Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and Newfoundland and Labrador.”

* “Most of the nickel mined in Canada comes from the Thompson Nickel Belt in Manitoba; the Sudbury Basin of Ontario; and the Ungava peninsula of Quebec.”

* And, finally: “Ontario is Canada’s leading producer of gold, responsible for over half the national total. Most of this gold is mined from lode deposits, especially from the three mines in the Hemlo area and the two mines in the Red Lake area.”

4. Is something horrible for Canada (and the United States etc) lurking ahead in any case?

A recent article on parallel oil-induced dynamism in the Gulf-state economies of the Middle East has raised a query that arises for Canada’s apparent recent burst of economic strength as well: “The big question is: Can these good times last?” (Even allowing that, as Prime Minister Harper in Canada has just noted too: “We’re certainly aware that a high dollar creates some difficulties as well as having some advantages … It depends on the sector and the circumstances.”)

A recent article on parallel oil-induced dynamism in the Gulf-state economies of the Middle East has raised a query that arises for Canada’s apparent recent burst of economic strength as well: “The big question is: Can these good times last?” (Even allowing that, as Prime Minister Harper in Canada has just noted too: “We’re certainly aware that a high dollar creates some difficulties as well as having some advantages … It depends on the sector and the circumstances.”)

The Vancouver Sun has spelled out some particular concerns here: “From a distance, the economy seems to be humming along quite nicely. But … a closer look reveals a shrinking manufacturing sector … the higher cost of exports due to the loonie’s rise … and a slowdown in the United States, Canada’s largest export market …even consumers are apparently not convinced that the good times will continue to roll, according to a survey that found their confidence sagging on concerns about job layoffs down the road if things turn bad.”

The gloom-and-doom prophets carry on: “Canadian employment continued to rise in October, split between full and part time, pulling the jobless rate down a notch to its lowest level since 1974 … But TD Bank deputy chief economist Craig Alexander said … something does not add up … There is a considerable dichotomy between the employment gains and recent economic data … Either employment growth is going to slow remarkably fast or forecasters, such as ourselves, have completely misjudged the underlying strength of the economy’… National Bank of Canada economist Stefane Marion also admitted to being baffled’ that the public sector which accounts for just 19 per cent of total employment, has accounted for all of the job growth for the past quarter year, while private sector payrolls have shrunk … This disconnect is unprecedented and we do not think that it can be sustained,’ Marion said.”

The gloom-and-doom prophets carry on: “Canadian employment continued to rise in October, split between full and part time, pulling the jobless rate down a notch to its lowest level since 1974 … But TD Bank deputy chief economist Craig Alexander said … something does not add up … There is a considerable dichotomy between the employment gains and recent economic data … Either employment growth is going to slow remarkably fast or forecasters, such as ourselves, have completely misjudged the underlying strength of the economy’… National Bank of Canada economist Stefane Marion also admitted to being baffled’ that the public sector which accounts for just 19 per cent of total employment, has accounted for all of the job growth for the past quarter year, while private sector payrolls have shrunk … This disconnect is unprecedented and we do not think that it can be sustained,’ Marion said.”

Perhaps the greatest worry is that the recent rapid rise in the Canadian dollar has in the end a great deal to do with the recent rapid fall in the value of the US dollar. And back this past September the eminent US economist Paul Krugman alluded to the most disturbing possibilities here: “Lots of buzz suddenly about the possibility of a sharp fall in the dollar. The Canadian dollar is back at parity with the greenback; there are rumors that the Saudis are planning to diversify into euros, and maybe even that the Chinese might break the dollar peg …

“I could say that I saw this coming; the problem is that I’ve been seeing it coming for several years, and it keeps not arriving (and I don’t know if this is really it, even now.) The argument I and others have made is that the U.S. trade deficit is, fundamentally, not sustainable in the long run, which means that sooner or later the dollar has to decline a lot. But international investors have been buying U.S. bonds at real interest rates barely higher than those offered in euros or yen – in effect, they’ve been betting that the dollar won’t ever decline.

“I could say that I saw this coming; the problem is that I’ve been seeing it coming for several years, and it keeps not arriving (and I don’t know if this is really it, even now.) The argument I and others have made is that the U.S. trade deficit is, fundamentally, not sustainable in the long run, which means that sooner or later the dollar has to decline a lot. But international investors have been buying U.S. bonds at real interest rates barely higher than those offered in euros or yen – in effect, they’ve been betting that the dollar won’t ever decline.

“So, according to the story, one of these days there will be a Wile E. Coyote moment for the dollar: the moment when the cartoon character, who has run off a cliff, looks down and realizes that he’s standing on thin air – and plunges. In this case, investors suddenly realize that Stein’s Law applies – “If something cannot go on forever, it will stop” – and they realize they need to get out of dollars, causing the currency to plunge. Maybe the dollar’s Wile E. Coyote moment has arrived – although, again, I’ve been wrong about this so far.

“Much more about all this in a thoroughly incomprehensible paper I recently published in the European journal Economic Policy. Don’t bother clicking if you hate funny diagrams and Greek letters.”

“Much more about all this in a thoroughly incomprehensible paper I recently published in the European journal Economic Policy. Don’t bother clicking if you hate funny diagrams and Greek letters.”

There is no need to become unduly pessimistic about all this. Whatever happens, hard-working North Americans are going to survive and continue, in one way or another, to thrive as well. And what has been going on recently does show that Canada does have some singular economic virtues – historically and in the here and now. North America does have its own oil supply of some consequence. Even Central Canada continues to have a diversified economic base that can be resilient in the face of challenges to particular sectors. And on and on. The prudent point is just that it pays to look at the future with a sober-minded realism. Canada has been doing this for a number of centuries now. And that’s one reason it still survives, despite so many contrary prophecies. The cold weather breeds tough-mindedness about what lies ahead, even in the age of global warming?

UPDATE NOVEMBER 19: The loonie has subsequently come down still more from its $1.10 high, though it remains slightly above par with the greenback as of 3:30 PM today ($1.01+). See “Canadian dollar slips in wake of Dodge comments” in the Vancouver Sun. And for the loonie’s current value in US $, whenever you happen to be reading this update, see the Yahoo Currency Converter.